|

UnAnswered

Questions for Mel Martinez

As a Republican Candidate for

Senate in 2004 you will need to convince Florida voters that you are fiscally

responsible and can be trusted to represent them and their families. The

following questions are intended to help illuminate your performance by

"following the money trail" through key areas of your personal

responsibility:

|

As HUD*

Secretary (2001-2003)

- Why

is $59 billion still missing from your Agency, namely HUD[*],

and who has the $59 billion?

Even before you

took office, HUD was cited by Congress for being financially

'high risk', open to massive fraud and waste. Indeed HUD's

own Inspector General testified in 2000 (just prior to your

arrival), that HUD could not account for $59.6 billion in

the prior year, or more than 50% of its mortgage guarantees

in that year. You

made little or no effort to investigate, recover the money,

or to hold the appropriate staff and government contractors

responsible. This has serious ramifications for the citizens

of a democracy, as well as for anyone dependent on US financial

integrity.

Links on the Missing $59 Billion:

____________

*HUD

is the US Deptartment of Housing & Urban Development

|

$59 billion missing

from HUD!

Where is the money, Mel?

In

other words,

in a single year HUD could not account for $59.6 billion,

and made 242 "adjustments" to fill in the gaps! |

- Who is reaping the greatest revenues

and profits from HUD?

Please state who is profiting the

most from these dealings directly:

- Who are the top 10 mortgage banking

originators of FHA mortgage insurance?

- Who are the top 10 Wall Street dealers

in Ginnie Mae securities?

- Who are the top 10 managers of Section

8 housing and other private housing subsidized and financed

by HUD?

- Who are the top 10 buyers and managers

of FHA foreclosed properties?

- Who are the top 10 developers and owners

of Hope 6 public housing deals?

- Who are the top 10 homebuilders in

the country whose business depends on HUD regulation and FHA

financing, either to purchase their homes or the homes of their

buyers?

- Who are the top 10 syndicators of low

income housing tax credits?

- Who are the top 10 government contractors

running FHA, Ginnie Mae and HUD internal operations?

- Who are the top 10 banks that serve

as HUD, FHA, and Ginnie Mae depositories and trustees?

- Who are the top 10 law, accounting,

and lobbying firms providing services related to HUD real estate,

mortgage and securities transactions and regulation?

Links

related to HUD Profiteering:

- HUD:

US Department of Housing & Urban Development

- Mr. Martinez directed HUD since January 24, 2001, resigning

December 2003 to run for US Senator in the state of Florida.

- FHA:

Federal Housing Administration - the

mortgage insurance operation within HUD

- Ginnie

Mae: Government

National Mortgage Association (Ginnie Mae) - the mortgage

securities operation within HUD; a wholly owned government corporation

providing liquidity to low-to moderate-income and first-time

homebuyers at the rate of about $125 billion a year; Ginnie

Mae mortgage backed securities are guaranteed by the US government.

- MBA:

Mortgage

Bankers Association - note that Mortgage bankers consistently

provide 80 to 85 percent of all FHA and VA home loans.

- NAHB:

National

Association of Home Builders - lobbies on behalf of the

building industry, which includes "monitoring and improving

the housing finance system."

- NAR:

National

Association of Realtors - one of the most powerful lobbying

groups in the nation, and the nation's largest contributor of

direct contributions to federal candidates.

- NMHC:

National Multi Housing Council - a leading

national advocate for the conventional apartment industry, including

housing

policy and finance, tax, technology, property management,

environmental issues and building codes.

- HFAs:

State Housing Finance

Agencies (HFAs) - state and local auhorities that administer

federally authorized housing programs, including mortgage bonds,

housing tax credits, block grants, and Section 8 contracts and

restructuring.

- NMN

Daily: National

Mortgage News - excellent research resource (subscriber

based).

- Contractors:

Eagle

Eye Map - breakdown of top federal contract and grant awards

by state, including for Florida.

- Who

is reaping the greatest HUD-related

profits on Wall Street?

Please state who is profiting the

most from these dealings indirectly:

- Who are the top 25 private and institutional

investors in the stock of the companies, REITs, and banks described

in (4) above,

and in the mortgage backed and tax-exempt bonds and tax syndications

they issue?

- What is the impact on the value of their

stock and bond portfolios from these companies' success as a

result of their profits from HUD?

Links

related to HUD

Profiteering on Wall Street:

- Securities

Industry Association

(SIA)

- Bond

Market Association - (formerly the Public Securities Association

(PSA)) is the trade association representing the largest securities

markets in the world -- the $17 trillion debt markets.

- Moody's

- excellent source for credit ratings, research and risk analysis;

tracks more than $30 trillion of debt.

- Standard

& Poor's - provider of independent investment data,

valuation, analysis and opinions; tracks $1.5 trillion in investors'

assets.

- EDGAR

Online - provides business, financial and competitive information

derived from SEC data (i.e. SEC Exposure documents, see Annual

Proxies for Large Investor, Board and Senior Management Disclosure).

- Who's who in campaign funding and HUD

profiteering?

Please state who else is profiting

indirectly from these dealings:

- How do the top companies, banks, and

investors making money at HUD compare to the lists of campaign

donors to your campaign, to the Republican Party, to President

George W. Bush, and to the soft dollar organizations that support

these campaigns?

Links

on Campaign

Donations:

- The war on "narco dollars"

at HUD

| Under your leadership

at HUD you were the top executive responsible for ensuring

that US mortgage markets and the US homebuilding industry

are free of "narco dollars" -- i.e. not used for

money laundering and financial fraud, including the laundering

of the profits of narcotics trafficking:

- What is the impact on the value

of US mortgage company and homebuilding stocks from the

$500 billion - $1 trillion of US money laundering annually?

- How would you assess your performance

at HUD in preventing such money laundering?

- How would you assess your performance

with respect to the Florida market, given the size of

narcotics trafficking revenues and profits in Florida?

Links on "Narco

Dollars":

|

In Tony

Soprano's mob world, HUD exists to facilitate embezzlement,

theft, and extortion... fiction, or reality TV?

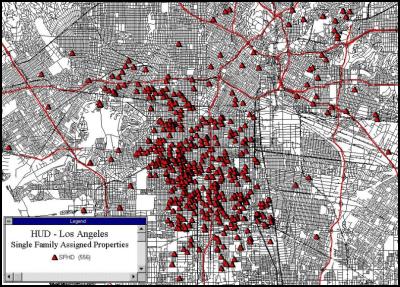

South

Central Los Angeles

Narco-HUD connection?

(click for larger image

& narration)

|

- Cooked books and back-door privatization

In fiscal years 1998 and 1999, HUD

had undocumentable adjustments of $17 billion and $59 billion,

and refused to finish its audit in fiscal 1999. Audits for fiscal

2000 and 2001 fail to disclose the amount of undocumentable adjustments

made to balance HUD's books. Contractors who had been paid hundreds

of millions of dollars to provide the computer systems that were

blamed for losing track of this money were not fired.

HUD has mysteriously operated its defaulted

mortgage portfolios at much lower recovery rates than are possible,

thus transferring FHA financial resources to private interests

in the billions of dollars annually. At the same time it has used

elevated recovery rates for purposes of issuing new originations.

Given HUD's 'high risk' financial atmosphere, with the FHA specifically

cited on the GAO's hotlist of top management concerns governmentwide,

the the opportunity for fraud is staggering.

- Where is this money going, and who is

getting it -- i.e. who is benefitting the most from HUD's failures

at financial management?

- What is the potential revenue, profits

and stock market capital gains that could be generated from

$17 billion and $59 billion, as well as several billion a year

in back-door privitizations on FHA's defaulted mortgage and

foreclosed property portfolio?

Links

on HUD "Cooked

Books" and "Piratization":

- Lax regulation

HUD is responsible for regulatory

oversight of the mortgage government sponsored enterprises, Fannie

Mae and Freddie Mac. Freddie Mac is currently under criminal investigation

by the Department of Justice related to "cooked books."

- Please explain how Freddie Mac could

have been cooking the books if its regulator was doing its job.

Links

on Lax Regulation:

- Availability of HUD financial data

It appears that HUD's sensitive financial

and demographic data can be accessed inappropriately by predatory

enterprises, whereas citizens cannot even access routine financial

data that is supposed to be made public.

- Which companies and banks listed in

(1) above have access to confidential government data subject

to the Privacy Act as a result of their roles with FHA, Ginnie

Mae and HUD?

- What steps are taken to insure that

this data is not shared with their investors and Wall Street?

- What is the value of such data for purposes

of insider trading and market rigging?

- Why does HUD refuse to make its contract

budget publicly available and accessible?

- Why are HUD's financials and portfolio

not publicly accessible on a place based basis?

- Why has HUD taken drastics steps to

suppress efforts to provide open citizen access to its software

tools and databases on HUD's portfolio?

Links

on HUD IT Contractors:

- Where

is the Collateral?, by Chris Sanders, Sanders Research Associates,

London

- On

the Money Trail, MetroActive, September 5, 2002

- The

Real Deal: Hitting On HUD, Scoop Media, August 12, 2002

- Dyncorp: high

level connections to Enron, engaged in underage sex-slave trafficking

overseas...

-

CSC

DynCorp & the Economics of Lawlessness, Scoop Media,

April 2003

-

Dirty

Tricks, Inc.: The DynCorp-Government Connection, Uri Dowbenko,

Consipiracy Digest

- AMS: under a $206 million

HUD contract, AMS installed the HUDCAPS system which was blamed

for HUD's financial fiasco

-

Federal

Lawsuit Adds to AMS Woes, Washington Technology, July 2001

- Lockheed: had a $526

million computer services contract at HUD 1990-2003, ending

when contract expired

-

HUD

drawing up IT overhaul, Federal Computer Week, July 4, 2001

($526 million to Lockheed 1990-2003)

- HUD

awards contract for $860m IT makeover, Govt Computer News,

Aug 25, 2003 (EDS 2003-2013)

- HUD

Selects Team ... to support Single Family National Servicing

Center, RGII Technologies, October 20, 2003

- US Mortgage Bubble

HUD is responsible for the health

of the US mortgage market. HUD runs a large mortgage insurance

operation called the Federal Housing Administration (FHA), and

a mortgage securities operation called the Government National

Mortgage Association (Ginnie Mae). HUD also regulates the government

sponsored mortgage enterprises Fannie Mae and Freddie Mac (currently

under investigation), which effectively underwrite the mortgage

market. Anyone can purchase a home loan guarantee that is issued

by the FHA and backed by the US Treasury, regardless of their

circumstances. If or when they default on their mortgage, their

bank submits a claim to the FHA for payment. The FHA is then expected

to recover as much of the loss as possible by either selling off

the defaulted loan, or foreclosing on the home. To the untrained

eye this appears legitimate, since there is theoretically a home

purchased in the bargain that serves as collateral.

However, in recent years the rate

of growth for home mortgages issued vs. homes purchased has increased

by more than 400.0% vs. 2.5% respectively. This means a significant

volume of mortgages is being mysteriously issued with no

collateral, creating a virtual mortgage bubble. At the

same time, HUD is only recovering roughly 35% on defaulted loans,

after cancelling a successful loan sales program that was recovering

70%. In short, the mortgage market is at risk.

- Please describe the expansion of Ginnie

Mae authorities and powers under your leadership at HUD. As

a Republican, please explain why you would promote government

agencies competing with healthy private markets and socializing

a significant amount of private markets into government.

- How does increasing the debt load of

minorities, first time homebuyers, and low income people help

them achieve the American dream? Wouldn't they be better off

with improved skills and competitive access to equity capital

to start businesses? Which is more helpful to such communities

-- more mortgage debt, or less narcotics trafficking and HUD

fraud (including intentionally high default rate policies combined

with low recovery rate resolutions)?

- What is the total number of Hope 6 units

under development during your leadership at HUD? What is the

total amount of FHA insurance, low income housing tax credits

and tax exempt bonds used to develop these units? How does this

flow relate to the US mortgage bubble and stock market. Who

were the developers of the two Hope 6 projects at the Orlando

Housing Authority, where you served as Chairman? Where else

are they the developers?

- There are allegations of significant

overissuance of tax-exempt single family mortgage bonds using

FHA insurance by the Arkansas Development Finance Agency as

part of schemes to launder and leverage the state share of profits

from the arms and narcotics trafficking at Mena Arkansas during

Iran Contra. Has this pattern of overissuance been a concern

with Florida state and local housing agencies?

- What is the relationship between the

US mortgage bubble and the "strong dollar policy"?

Links

on the Mortgage Bubble:

- Why does

HUD spend $100-250,000 per unit

to construct public housing apartments when single family housing

can be purchased and repaired in the same neighborhood for $50-100,000?

And why are felons allowed to develop and manage Hope VI housing

while tenants

can be evicted for having a felony record?

Links related to Hope VI Housing Program:

- The American

Dream Downpayment Act authorizes grants which will help minorities

buy homes – will it be the same minorities who were denied

votes in 2000?

Links on the American

Dream Downpayment Act:

The American Dream Down Payment Act, H.R. 1276, was introduced

by Rep. Katherine Harris (R-FL) (Co-Chair with Mel Martinez

of the Bush Florida Campaign 2000 and Florida Secretary of State

whose office purged the rolls of approximately 57,000 minority

Florida voters in 2000), and approved in the House of Representatives

by a voice vote on Wednesday, October 1, 2003:

-

Why do you apply opposite standards of personal responsibility

– i.e. evicting tenants in HUD housing when their children

use drugs, vs. supporting Bush Iran Contra colleagues who deal

in or protect hard narcotics trafficking to children?

As

Secretary of HUD you were entrusted with over $100 billion per

year in appropriations and loan guarantees, and were responsible

for HUD's performance both financially and ethically. Yet it appears

that HUD and its big contractors were exempted from the most basic

standards of performance, integrity, and accountability, whereas

innocent people were held to impossible standards and made to

suffer severe consequences for not living up to them.

$59.6

billion in undocumented adjustments was reported missing from

HUD just before you assumed office (see UnAnswered

Question #1 above), yet you made no discernable effort

to clean up the fiscal mess left by the Democrats – you

did not demand a complete audit, rigorously investigate, recover

the money, or even hold the responsible contractors accountable;

under your leadership HUD refused to disclose its undocumented

adjustments for subsequent audits, and remains on the GAO's financial

"high risk" list, while the FHA (part of HUD) is still on the

GAO's top 10 "management challenges." HUD is cooking its books

by manipulating recovery rate

assumptions and refusing to report undocumented adjustments, and

Freddie Mac is under investigation for cooking its books.

Links on Lax

HUD and Freddie Mac Accountability:

- Freddie,

Fannie Escape Action on Hill -- for Now Effort Stalls

to Impose New Regulatory System on Giant Mortgage Buyers,

By David S. Hilzenrath, Washington Post, November 17, 2003

- Inside

HUD's Financial Fiasco, by Kelly O'Meara, Insight Magazine,

June 2001

- HUD's

Financial Woes Continue, by Kelly O'Meara, Insight Magazine,

April 18, 2003

- Major

Management Challenges and Program Risks, Government Accounting

Office (GAO), January 2001

- FHA:

reference High Risk Areas chart (page 31/33) "HUD

single family..." which falls

under the FHA within HUD

- HUD Audits:

Re: the "clean" audit opinion filed by HUD

for FY2000, most federal

agencies "have only been able to obtain unqualified audit

opinions through heroic efforts, which include using extensive

ad hoc procedures and making billions of dollars in adjustments

to derive numbers as of a single point in time -- the end of

the fiscal year. [...] cannot dependably and routinely produce

annual financial statements and other information needed to

manage day-to-day operations. [...] do not comply substantially

with federal accounting standards or financial systems and other

requirements." (page 16/18).

- Wasted

Riches, by Kelly O'Meara, Insight Magazine, October 2001

- 'High

Risk' Finance at the Federal Level, by Kelly O'Meara, Insight

Magazine, August 2003

Under

your leadership HUD evicted Pearlie Rucker along with her grandchildren

and great-grandchild when her mentally disabled daughter was caught

with drugs several blocks from home; yet George Bush's family

was not evicted from public housing (the White House) when his

daughters were caught attempting to obtain alcohol illegally,

nor was Jeb Bush's family evicted from public housing (the Governor's

mansion) when his daughter was convicted of a drug crime -- she

was instead mercifully sent to rehab and then allowed to return

home in spite of violating the terms of rehab [8].

Links on Pearlie

Rucker and the Bush Daughter:

Summary:

Pearlie Rucker lived with her grandchildren and great-grandchildren

in public housing; her daughter was stopped blocks away from

the site for drunkennes.

When searched they found drugs on her person; no drugs

were found in Pearlie's home.

Perlie and her

entire family were

evicted. On the other

hand, Jeb Bush's daughter was arrested for drug fraud,

sent to rehab treatment, broke terms of rehab twice and spent

a few days in jail, then was released home

to her parents (home

being another form of public housing, the governor's mansion).

Jeb and his wife and

daughter were not evicted.

- One

Strike for the Poor and How Many for the Rest of Us?, Legal

Archives summary with

link to full article

- AARP

Urges U.S. Supreme Court To Protect The Rights Of Low-Income

Tenants, AARP, January 22, 2002

- Supreme

Court Upholds Zero Tolerance in Public Housing, Drug War

Chronicle, March 29, 2002

-

Legal documents and analysis, National Housing Law Project

(search

on "Rucker" to see links to specific

documents)

- Jeb

Bush's daughter charged with prescription fraud, USA Today,

01/29/2002

- Jeb

Bush's Daughter Out Of Rehab, CBS News, Aug. 8, 2003

Under

your leadership HUD refused to pay the $2 million owed to Hamilton

Securities for financial services rendered which saved HUD and

the taxpayers over $2 billion in defaulted loan sales, and you

continued to support the legal persecution of Catherine Austin

Fitts, president of Hamilton and former Assistant Secretary of

Housing under Bush I.

Links on HUD

Contractor Hamilton Securities:

Summary:

Ervin & Associates and the US Government shut down Hamilton

Securities after Hamilton saved HUD $2 billion under a $2 million

contract and developed software for citizens to learn about

HUD spending by place; they seized the software, bankrupted

the company, took it to trial eight years and 18 audits later,

and never produced any evidence of wrongdoing.

And

yet, under your leadership HUD has maintained enormous contracts

involving access to HUD's most sensitive data with large defense

contractors, including AMS (paid hundreds of

millions of dollars for installing HUD's faulty accounting system

"HUDCAPS," which the HUD Inspector General identified

as the primary reason that tens of billions went missing) and

Dyncorp (implicated through federal contracts

in Eastern Europe in human slave trafficking and pedopholia).

Links on Criminal

Activities of HUD Contractors AMS and Dyncorp:

- DynCorp

Disgrace, By Kelly Patricia O'Meara, Insight Magazine, Jan.

14, 2002

- Dirty

Tricks, Inc.: The DynCorp-Government Connection, Uri Dowbenko,

Consipiracy Digest

- What

Does It Take to Lose a Contract?, by Kelly O'Meara, Feb.

25, 2001

- The

Real Deal: Hitting On HUD, Scoop Media, August 12, 2002

|

...

Return to Questions Summary ...

More links or comments or questions?

Post

them on the Forum

Top • Back

to Mel Martinez Summary • Hotseat

Homepage

|

|